tax shield formula excel

And this net effect is the loss of the tax shield. How to calculate after tax salvage value.

Tax Shield Formula Step By Step Calculation With Examples

Tax shield deduction x tax rate 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐜𝐞 𝐨𝐟 𝐓𝐚𝐱 𝐒𝐡𝐢𝐞𝐥𝐝 ---------------------------------------------- tax shield lower tax bills which is one of the major.

. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest. However adding back the protection is not straightforward because we need to consider the net effect of losing a tax shield. Interest Tax Shield Interest Expense x Tax Rate The APV approach allows us to see whether.

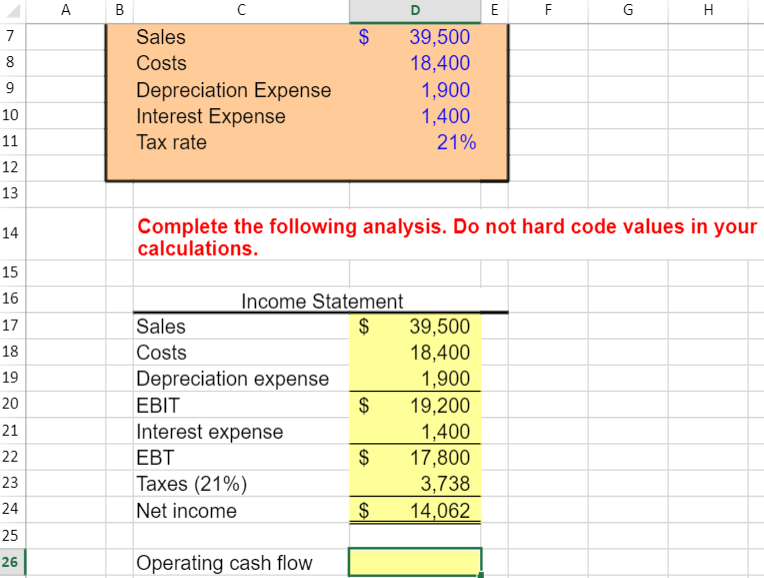

Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k While Company A does have a higher net income all else being equal Company B. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. For depreciation an accelerated depreciation method will also allocate more.

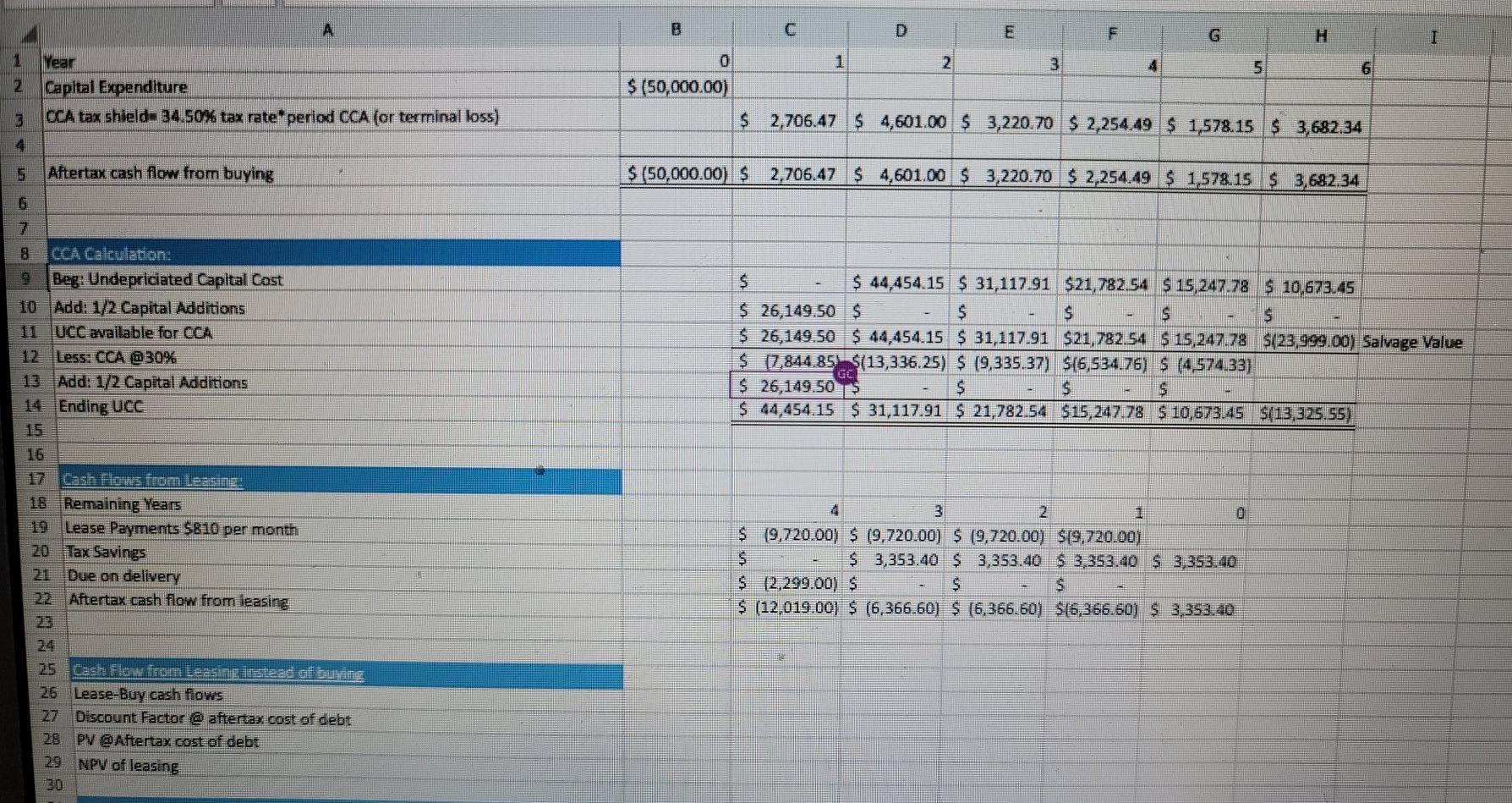

PV of CCA Tax Shield FormulaWhereI Total Capital Investmentd CCA tax rateTc Corporate Tax Ratek discount rateSn Salvage value in year nn number of periods in. From the above calculation we. 1-046 24 1.

In the line for the initial cost and salvage value NCS the salvage value should have a negative sign negative spending. Interest Tax Shield formula Sum of Tax-Deductible Expenses Tax. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Formula to Calculate Tax Shield Depreciation amp. The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

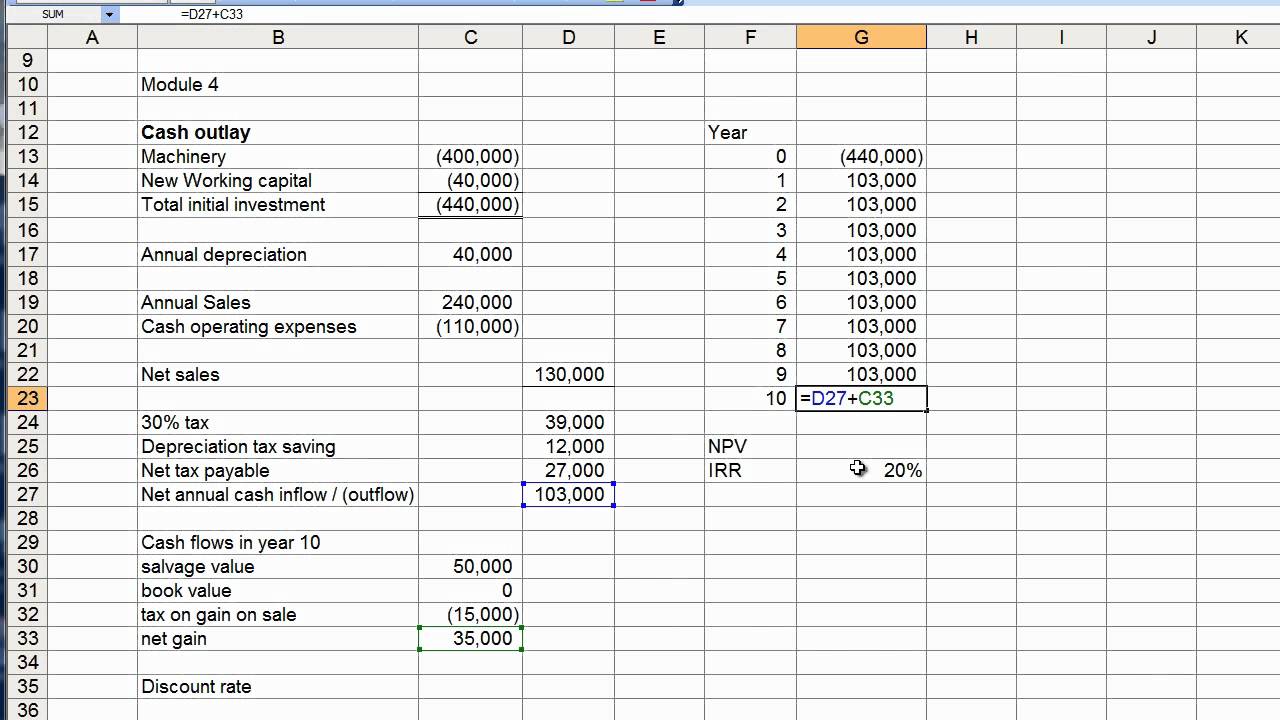

Tax Equivalent Yield Tax Free Yield 1 Tax Rate Or Tax Yield 8 1 35 Or Tax Yield 008 1 035 Or Tax Yield 008 065 01230 123. How do you calculate tax shield in Excel. FORMULAS Year Pre-tax Income Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note.

In the line for the initial cost.

Solved All Values Must Be Entered As An Excel Formula Chegg Com

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

Interest Tax Shield Formula And Calculator Step By Step

Chapter 13 Leverage And Capital Structure Ppt Download

Tax Shields Financial Expenses And Losses Carried Forward

A B D F G I 1 2 3 4 5 6 Year Capital Expenditure Cca Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Definition Formula Example Calculation Youtube

Calculating Pre Tax Cost Of Equity In Excel Fm

Tax Shields Financial Expenses And Losses Carried Forward

How To Calculate Income Tax In Excel

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Step By Step Calculation With Examples

Module 4 Discussion Npv Calculation Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance